While Fed taper talk is heating up again, it is important to distinguish between tapering and tightening. In the absence of a major inflation threat, the Fed has made it clear that it prefers to err on the side of “too late and too loose” rather than “too early and too tight”.

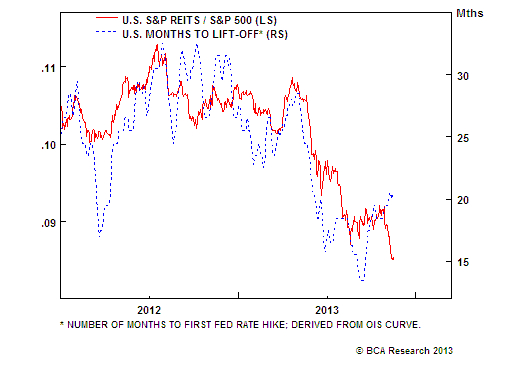

Indeed, the above chart is compelling – the relative share price ratio has a close correlation with the number of months to the first Fed hike. The latter has climbed anew, underscoring that there is a chance to trade REITs from the long side. Value is attractive and cash flow prospects are improving alongside overall economic growth. Our U.S. equity strategists reiterate their recent upgrade to overweight.

Please share this article

No comments:

Post a Comment